PMEGP Backs Small Units, ₹10 Lakh Projects Lead

Manufacturing and service enterprises with low project cost dominate assistance under PMEGP in last five years

- 63% manufacturing and 93% service units aided had projects up to ₹10 lakh

- Priority given to small-ticket projects under PMEGP

- No collateral required for loans up to ₹10 lakh

- CHAMPIONS portal strengthens grievance redressal for MSMEs

GG News Bureau

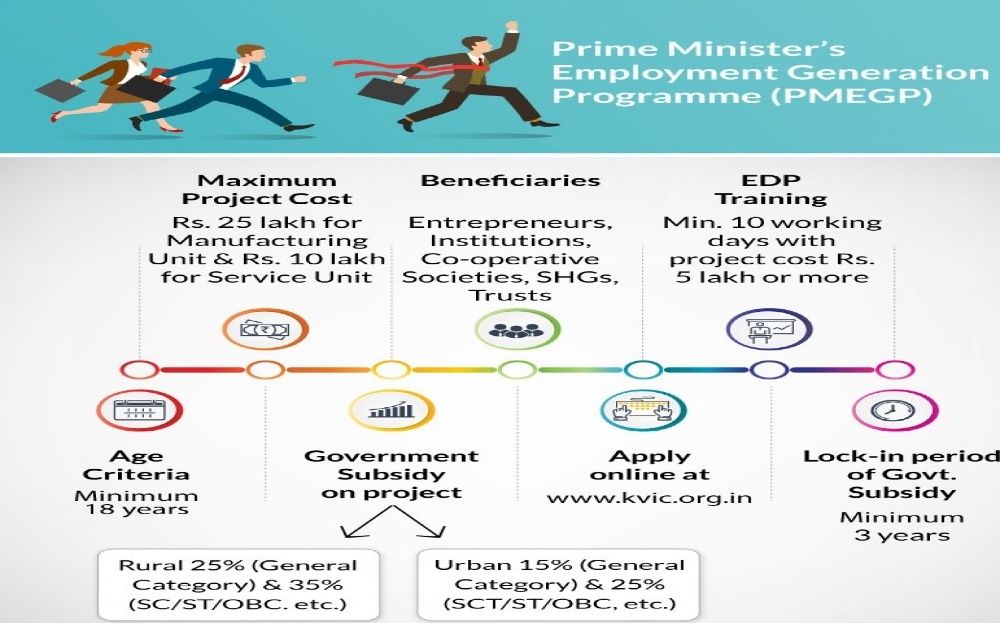

New Delhi, 2nd Feb: The Prime Minister’s Employment Generation Programme (PMEGP) has primarily supported small-scale enterprises over the last five years, with nearly 63 per cent of assisted units in the manufacturing sector and 93 per cent in the service sector having project costs of up to ₹10 lakh.

PMEGP, a central sector scheme of the Ministry of Micro, Small and Medium Enterprises, facilitates the setting up of new micro-enterprises through small loans and subsidies. During the period from FY 2020–21 to FY 2024–25, the scheme has focused on enabling first-time entrepreneurs and small projects to generate local employment.

To further ease access to credit, the Ministry has accorded priority to applications involving project costs below ₹10 lakh. As per Reserve Bank of India guidelines, banks are not permitted to insist on collateral security for loans up to ₹10 lakh, a provision whose strict compliance has been reiterated to lending institutions.

Additionally, no educational qualification is required for setting up manufacturing projects costing up to ₹10 lakh and service sector projects up to ₹5 lakh, lowering entry barriers for aspiring entrepreneurs.

The Ministry is also operating the CHAMPIONS portal—Creation and Harmonious Application of Modern Processes for Increasing the Output and National Strength—to ensure speedy and effective grievance redressal. The portal provides handholding support to MSMEs, connects them with officials of central and state governments, lending institutions and other agencies, and offers guidance on government schemes and policies.

Interest rates for PMEGP loans are determined by individual banks, as RBI has deregulated interest rates on bank advances. However, RBI has directed all regulated entities to maintain transparency and fairness in loan terms, enabling PMEGP beneficiaries to make informed decisions and preventing arbitrary interest recovery. Banks have also been instructed to accord priority in sanctioning PMEGP projects.

The information was shared by Minister of State for MSMEs Shobha Karandlaje in a written reply to the Rajya Sabha on Monday.