LIC Under Fire: Adani Allegations Expose Congress’s ATM Past

"Satire and Spin: Modi, Adani, and Congress’s New Ammunition."

Paromita Das

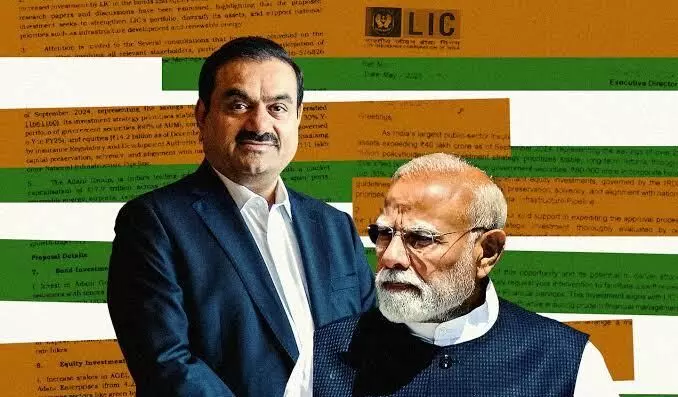

New Delhi, 28th October: Bharat’s political battleground has found its latest flashpoint in meme culture and investment controversies. After an American media outlet reignited claims that the Modi government “forced” Life Insurance Corporation (LIC) to funnel billions into Adani shares, Congress seized the opportunity with signature sarcasm—posting images of Modi handing Adani giant cheques and labeling the investment as “just 33,000 crore rupees.” Social media timelines have been flooded with punchlines: “Modi Hai To Mumkin Hai.”

Modi Hai To Mumkin Hai pic.twitter.com/Ov5BlqhFzn

— Congress (@INCIndia) October 25, 2025

Amid this digital blitz, the facts reveal a vastly different picture. LIC itself, as well as Adani, has denied the allegations, insisting that investments were made with professional due diligence, and the returns on Adani stocks have been solidly positive. Adani stocks held by LIC are a fraction of its overall portfolio, dwarfed by holdings in corporate giants like Reliance, Tata, SBI, and ITC. LIC’s equity in Adani, standing around ₹60,000 crore, pales in comparison to ₹1.3 lakh crore in Reliance and ₹82,800 crore in ITC.

3,30,00,00,00,000 रुपए मात्र pic.twitter.com/VB0nQALmHA

— Congress (@INCIndia) October 25, 2025

LIC Under UPA: The Forgotten Bailout King

Ironically, Congress’s outrage now contrasts starkly with its own record. During the UPA years, LIC wasn’t just an investor—it was a financial fireman for the government. Facing fiscal deficits and failing disinvestment targets, the UPA frequently tapped LIC to bail out loss-making public sector stocks. When private bidders shied away from PSUs saddled by underperformance, government ministers relied on LIC policyholder funds to meet disinvestment quotas and window-dress budget shortfalls.

From 2009-2014, LIC repeatedly rescued high-value disinvestment drives: in NTPC’s FPO, it bought nearly half the offer, stepping in with ₹4,058 crore; in NMDC’s stake sale, LIC took up 63.72%, investing ₹6,310 crore; in ONGC’s OFS, LIC absorbed an astronomical 96%—a whopping ₹12,179 crore. Each rescue allowed the UPA to book revenues and temporarily mask deficits for fiscal years that would otherwise have faltered.

LIC’s presence as a bailout buyer extended to Hindustan Copper, SAIL, BHEL, and a host of banks, steadily acquiring majority stakes when no one else would. The insurer even bought deferred-liability oil bonds—adding long-term strain to its portfolios—to help balance the government’s books.

Transparency and Performance: Contrasting Modi and UPA Eras

Unlike UPA’s crisis-driven bailouts, LIC’s investments in recent years—including its exposure to Adani—have been independently vetted, routinely disclosed, and have yielded notable profits. No evidence has substantiated the claim that government officials forced LIC into Adani bonds or shares; the insurer’s investments have been subject to oversight from SEBI and IRDAI, regular board approvals, and multiple independent audits.

LIC’s conservative strategy targets undervalued but stable stocks, buying low and holding through volatility—a sound approach for safeguarding policyholder interests. That includes buying Adani shares after the Hindenburg controversy when prices were down, and selling on recovery, generating substantial gains.

While Congress accuses the Modi government of favoring crony capitalism, its own tenure was marked by opaque fiscal practices, high deficits, and the use of LIC as a hidden lifeline for loss-making state-run enterprises. In the hard numbers, LIC’s exposure to Adani is less than its stakes in several other top-tier Bharatiya companies, and private and global investors now lead in Adani’s latest funding rounds.

Political Irony and Public Memory

The latest Congress campaign attempts to reclaim moral high ground on LIC’s investments but risks backfiring, given its own ATM-era legacy. The meme wars on social media distract from a deeper reality: every government relies on institutional investors, and every regime faces choices between profit, policy, and politics.

Congress’s real Achilles’ heel is its history—not just on LIC—but on all institutional interventions driven by short-term fiscal needs. The truth is that transparent investing, guided by regulated procedures and market discipline, has produced better outcomes for LIC policyholders than forced bailouts or backdoor fiscal fixes.

Investment Realities vs. Political Theatrics

As the headlines roar about LIC, Adani, and the government, the facts speak louder than memes. LIC remains independently managed, its Adani stake profitable, and allegations about forced investments remain unsubstantiated. Congress may mine nostalgia for political gains, but today’s investment landscape is more open, more diversified, and far less prone to old bailouts.

For voters and policyholders, the debate is instructive—reminding all that financial institutions thrive when shielded from politics, not weaponized by it. The lesson: accountability and transparency are better “Brahmastras” than political memes.