India’s GDP Seen at 7.4% in FY26: Economic Survey

Consumption, investment power growth; exports hit record, banking stress at multi-decade low

- FY26 GDP growth estimated at 7.4%, fastest among major economies

- Private consumption share rises to 61.5% of GDP

- Manufacturing grows 8.4% in H1 FY26, services GVA up 9.3%

- Gross NPAs fall to multi-decade low of 2.2%

GG News Bureau

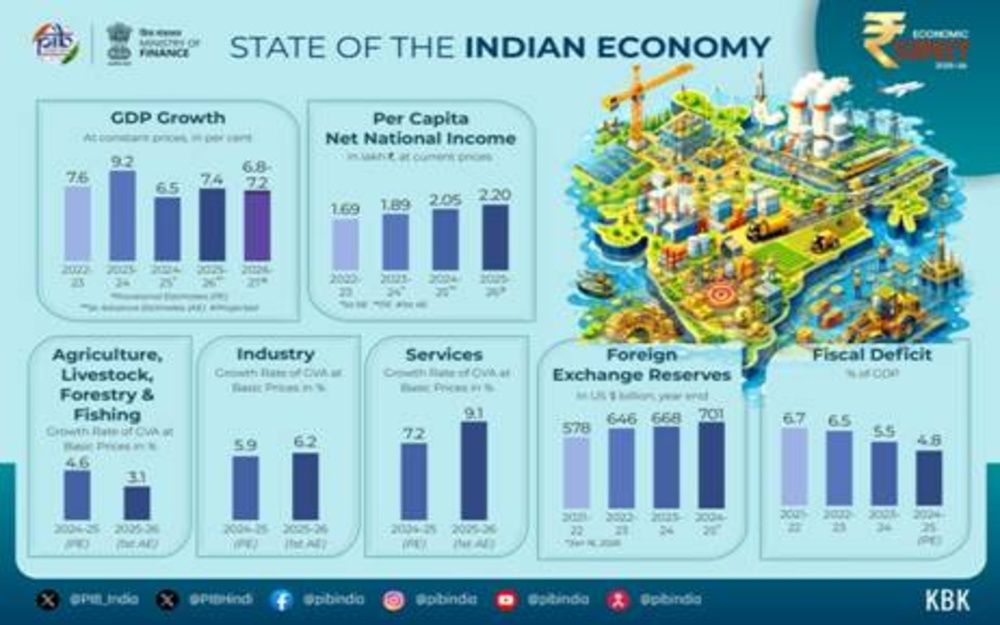

New Delhi, 29th Jan: India’s GDP growth for FY26 is estimated at 7.4 per cent, driven by strong consumption and investment, reaffirming India’s position as the fastest-growing major economy for the fourth consecutive year. This was highlighted in the Economic Survey 2025-26 tabled in Parliament by Union Finance Minister Nirmala Sitharaman on Thursday.

The Survey projects real GDP growth for FY27 in the range of 6.8 to 7.2 per cent, with India’s potential growth estimated at around 7 per cent, supported by resilient domestic demand and continued structural reforms.

Private Final Consumption Expenditure (PFCE) rose to 61.5 per cent of GDP in FY26, reflecting low inflation, stable employment conditions and rising real purchasing power. Rural consumption was supported by strong agricultural performance, while urban demand improved following tax rationalisation.

Investment remained a key growth anchor, with Gross Fixed Capital Formation (GFCF) estimated at 30 per cent of GDP. GFCF expanded by 7.6 per cent in the first half of FY26, exceeding last year’s pace and staying above the pre-pandemic average.

Agriculture and allied services are estimated to grow by 3.1 per cent in FY26, supported by a favourable monsoon. Allied sectors such as livestock and fisheries continued to expand at stable rates of 5–6 per cent, lending resilience to overall farm sector growth.

The industrial sector showed renewed strength, with manufacturing growing 8.4 per cent in the first half of FY26. Construction remained resilient on the back of sustained public capital expenditure and infrastructure momentum. Overall, industrial growth for FY26 is projected at 6.2 per cent.

On the supply side, services remained the main growth driver, with services GVA rising 9.3 per cent in the first half of FY26 and projected at 9.1 per cent for the full year, indicating broad-based expansion across sub-sectors.

Inflation eased sharply, with headline CPI declining to 1.7 per cent, led by lower food prices. The benign inflation environment supported real incomes and consumption, while fiscal discipline and capital spending reinforced growth quality.

India’s banking sector further strengthened, with gross NPA ratios declining to 2.2 per cent, a multi-decade low. Lending rates eased following repo rate cuts, improving credit conditions for businesses and households.

On the external front, India’s total exports (merchandise and services) reached a record USD 825.3 billion in FY25, with continued momentum in FY26. The recently concluded India–EU Free Trade Agreement, along with deals with the UK, Oman and New Zealand, is expected to open new opportunities for exporters.

The Survey notes that despite global uncertainties, India’s macroeconomic fundamentals remain strong, with healthy balance sheets, stable inflation, robust domestic demand and rising investment, supporting steady growth in the years ahead.