By Harshita Rai

Since its formation in 2014, Telangana has steadily carved a niche for itself as a vibrant hub of industry, innovation, and culture. Strategically perched on the Deccan plateau, the state has leveraged its unique geographic and cultural position to emerge as a leader in sectors ranging from food processing and pharmaceuticals to aerospace, defence, and handicrafts. Recent GST reforms have injected fresh momentum into this growth story, making products more affordable, enhancing competitiveness, and strengthening livelihoods across the state.

Food Processing: From Farm to Global Markets

Telangana’s food processing sector, powered largely by MSMEs, processes nearly a quarter of the state’s agricultural output through over 4,000 factories and 80,000 informal units. Processed foods already constitute more than half of the state’s agricultural export value. GST rate reductions, spanning items such as Banaganapalle Mangoes, Tandur Redgram, UHT milk, paneer, dry fruits, and snacks, have cut retail prices by 6–7%. These reforms not only make food more affordable for consumers but also increase procurement from farmers, stimulate MSME growth, and enhance the state’s reputation as a leading agro-industrial hub.

Life Sciences & Pharmaceuticals: Strengthening Health and Jobs

Hyderabad, dubbed the “Life Sciences Capital of India,” anchors Telangana’s pharmaceutical ecosystem, home to 800+ firms generating over 4.5 lakh jobs since 2014. The sector contributes nearly half of India’s bulk drug exports and one-fifth of total pharma exports. Recent GST reductions—dropping rates from 12% to nil for select cancer drugs and 12% to 5% on medicines for personal use—translate to 6–7% cost relief, making healthcare more accessible while boosting innovation, production, and export potential.

Aerospace & Defence: Powering Strategic Excellence

Telangana has emerged as a critical aerospace and defence manufacturing hub. Hyderabad hosts over 25 large firms, 1,000+ MSMEs, and premier research establishments like DRDO and ISRO. Exports of aircraft, spacecraft, and related parts accounted for nearly 31% of Telangana’s total exports in 2024–25. GST rationalisation on unmanned aircraft, defence vehicles, and key components reduces production costs, enhances domestic procurement efficiency, and strengthens the state’s global competitiveness in strategic manufacturing.

Automobiles & Auto Components: Driving Growth and Exports

With major players like Mahindra, Hyundai, and MRF Tyres, Telangana exported auto components worth ₹177 crore and cars worth ₹79 crore in 2023–24. Recent GST cuts on auto parts, three-wheelers, and small vehicles enhance competitiveness by lowering production costs and reducing prices for end consumers, reinforcing the state’s role in the automotive supply chain.

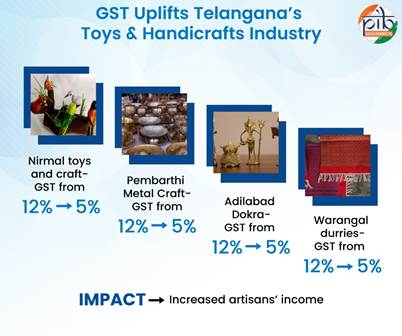

Traditional Crafts & Toys: Preserving Heritage, Boosting Incomes

Telangana’s handicrafts, including Nirmal toys, Pembarthi brassware, Adilabad Dokra, and Warangal durries, exemplify India’s rich artisanal heritage. GI-tagged crafts now enjoy GST reductions from 12% to 5%, translating to ~6% price drops. This makes these products more competitive domestically and internationally, increases artisan incomes, and sustains traditional skills for future generations.

Conclusion: Inclusive Growth Through GST

GST reforms are catalysing Telangana’s economic journey by lowering costs, boosting competitiveness, and expanding market access. Across sectors—food processing, pharmaceuticals, aerospace, defence, automobiles, and handicrafts—these tax rationalisations promote affordability, innovation, and export growth. For Telangana, GST is more than a tax measure; it is a strategic tool driving industrial progress, supporting artisans, and shaping a future-ready state poised for inclusive and sustainable development.