Budget 2026 Pivots to Deep Financial Sector Reform

Banking review panel, NBFC roadmap and PFC–REC restructuring signal long-term push for a resilient Viksit Bharat economy

- High-level committee to review banking sector structure and regulation

- Clear “Vision for NBFCs” aligned with Viksit Bharat 2047 goals

- Proposed restructuring of PFC and REC to strengthen infrastructure finance

- Focus on stronger regulation, deeper markets and efficient public lenders

GG News Bureau

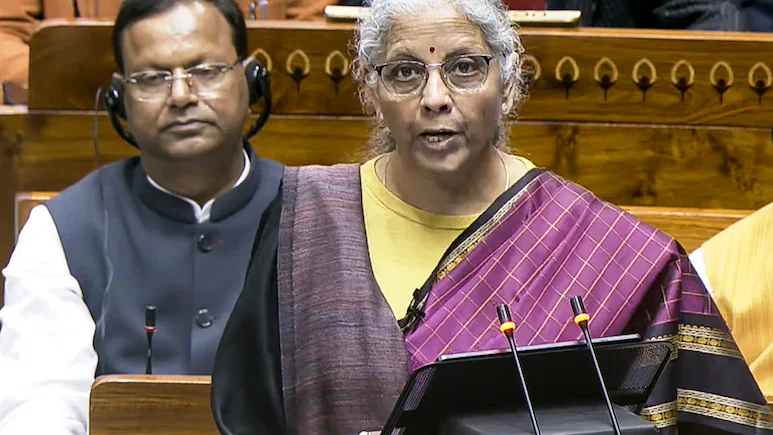

New Delhi, 1st Feb: In the Union Budget 2026, Finance Minister Nirmala Sitharaman unveiled an ambitious roadmap to overhaul India’s financial sector architecture, signalling a decisive shift towards stronger regulation, deeper capital markets and more efficient public financial institutions.

The proposals span banks, non-banking financial companies (NBFCs), specialised state-owned lenders such as Power Finance Corporation (PFC) and REC, and even the broader foreign exchange management framework. Taken together, they reflect a long-term strategy to build a more resilient and growth-ready financial system aligned with the vision of Viksit Bharat.

A key announcement was the formation of a high-level committee to undertake a comprehensive review of the banking sector. This move indicates that the government is looking beyond incremental reforms and is prepared to re-examine the structure, regulation and functioning of banks in a holistic manner.

The committee is expected to examine issues such as capital requirements and governance of public sector banks, competition and consolidation between public and private banks, risk management and cyber resilience, and the flow of credit to priority sectors. For banks, this could translate into fresh recommendations on ownership norms, governance standards and possible consolidation or specialisation, while for depositors and borrowers, the aim is a safer and more efficient banking system.

The Budget also outlined a clear vision for NBFCs for Viksit Bharat, recognising their crucial role in extending credit to MSMEs, small borrowers, rural areas and niche sectors where traditional banking penetration remains limited. The roadmap suggests that NBFCs will continue to be central to India’s credit ecosystem, but within a more clearly defined and closely supervised regulatory framework aligned with the country’s long-term development goals.

As part of efforts to strengthen public sector financial institutions, the Finance Minister proposed the restructuring of PFC and REC, two major lenders to the power sector that are increasingly financing broader infrastructure segments. The move is aimed at improving their efficiency, governance and ability to support India’s expanding infrastructure needs.

Overall, the financial sector measures announced in Budget 2026 underscore the government’s intent to move towards a more robust, well-regulated and growth-oriented financial system capable of supporting India’s economic ambitions over the coming decades.