PM Jan Dhan Yojana Completes 11 Yrs of Transformative Impact

- World’s largest financial inclusion programme marks milestone.

- 56.16 crore accounts opened, deposits at ₹2.68 lakh crore.

- 67% accounts in rural/semi-urban areas, 56% owned by women.

GG News Bureau

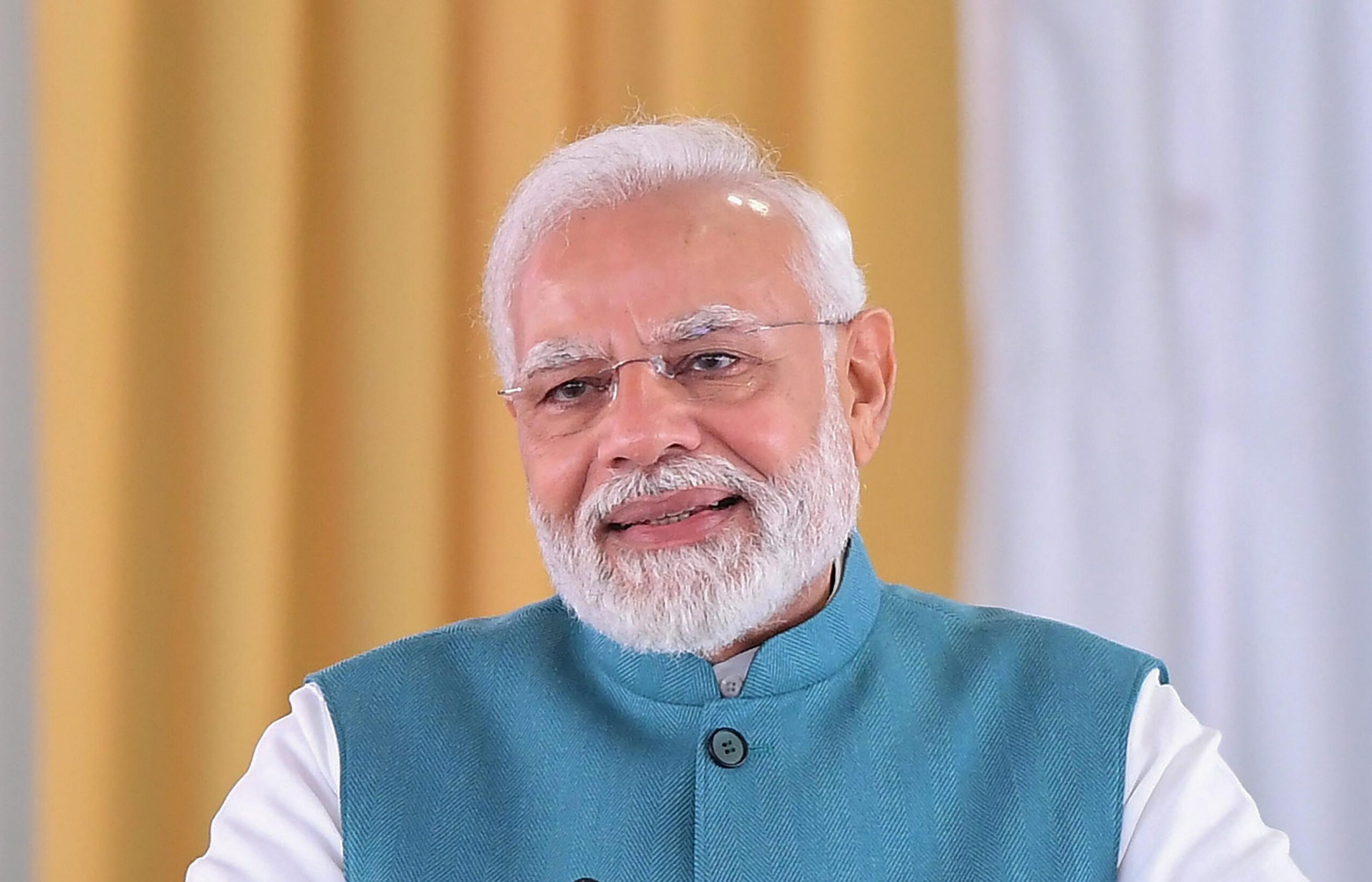

New Delhi, 28th Aug: The Pradhan Mantri Jan Dhan Yojana (PMJDY), the world’s largest financial inclusion initiative launched by Prime Minister Narendra Modi on 28th August 2014, has completed 11 years of empowering millions of underserved Indians with access to banking, savings, and social security.

Union Finance Minister Nirmala Sitharaman highlighted that more than 56 crore Jan Dhan accounts have been opened with deposits totalling ₹2.68 lakh crore, while 67% of the accounts belong to rural and semi-urban areas and 56% are owned by women. Calling PMJDY “a cornerstone of inclusive growth,” she said the scheme has ensured that “the poor and marginalised can participate fully in the formal economy.”

Minister of State for Finance Pankaj Chaudhary called PMJDY “one of the most successful financial inclusion initiatives in the world,” stressing that the scheme represents “dignity, empowerment and opportunity.”

At the heart of India’s financial inclusion strategy is the Jan-Dhan-Aadhaar-Mobile (JAM) trinity, which has created a diversion-proof subsidy delivery mechanism. In FY 2024-25 alone, over ₹6.9 lakh crore was credited directly into beneficiaries’ accounts under various DBT schemes.

Over the years, PMJDY has provided citizens not only with basic zero-balance accounts and free RuPay cards with insurance cover but also access to overdraft facilities, micro-insurance, pensions, and credit linkages, transforming financial behaviour at the grassroots.

Officials underlined that as PMJDY enters its 12th year, it continues to be a game-changer in financial empowerment, reducing dependence on intermediaries, enhancing digital adoption, and strengthening economic resilience at the last mile.